ACTUMAX

Corporate estate planing optimization

Actumax

Actumax™ leverages an advanced mathematical and financial model to provide tax practitioners, accountants, and notaries with customized estate planning solutions for their clients. This optimization software can be used to illustrate the added value of complex life insurance strategies and accurately measure their profitability, a truly distinguishing feat in the Canadian insurance market.

What s the added value of Actumax?

The added value of Actumax™ is undoubtedly the precision of the calculations performed, particularly in the context where corporate life insurance strategies remain in effect for several years. Taxation is also closely linked to any recommendation for corporate insurance. The relationship between funding a life insurance policy and accumulating funds in a corporate investment portfolio is complex and requires rigorous mathematical and fiscal analysis.

Actumax for Your Corporate Estate Planning Needs

Modeling the company’s investment portfolio

Breakdown of the annual return according to the different types of income earned (interest income, foreign income, Canadian dividends, realized and unrealized capital gains).

Selecting the appropriate insurance products

Analysis of the profitability of different types of insurance products according to the client’s situation (universal life, whole life, term life).

Calculating the impact of post-mortem planning strategies

mpact of using post-mortem planning strategies (164(6) of the Act vs. pipeline vs. combination of these strategies)

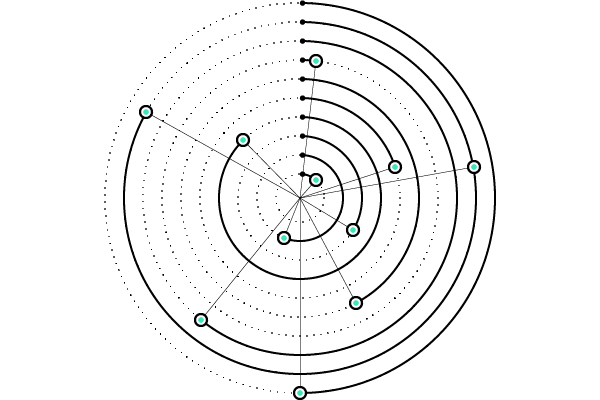

Calculation of the internal rate of return of the insurance strategy

The efficiency of the corporate life insurance strategy is measured in comparison with the annual return of the company’s investment portfolio.

Optimization

Advanced algorithm

Actumax™ is based on theoretical numerical analysis and its iterative methods which provides unparalleled accuracy with regards to the calculations and resulting recommendations. Actumax™ ‘s unique financial and tax modeling structure is based on the use of iterative methods where thousands of calculations are performed, which results in the optimization of the recommended strategies’ parameters. In addition, Actumax™ ’s integrated algorithm shows great flexibility with respect to the various calculation parameters. This in turn facilitates modelling the unique situation of the clients.

When the actuarial science meets engineering

The calculation of the internal rate of return using iterative methods illustrates the profitability of the insurance strategy in comparison with the annual return of a traditional investment portfolio (e.g. equity and bond portfolio).

Why have we created Actumax ?

In our opinion, the available estate planning tools and software do not encompass all the variables necessary in developing corporate estate planning strategies. The planning issues using life insurance are numerous and complex, which requires cross-disciplinary expertise in financial planning, financial mathematics and taxation. Actuxax is a tool that meets a very real need and above all, it is able to clearly demonstrate the advantages of corporate life insurance strategies.

Analysis – Calculations – Precision & Recommandations

The #1 solution for corporate estate planning strategies using life insurance products.